Worldwide personal and entry-level storage (PELS) shipments grew 13.6% year over year in 2013, According to IDC.

The increasing consumption and the production of the videos continue and

will continue to deeply influence the digital world in terms of technologies

development, and commercial opportunities. This reality is combined with the on-going

consumer education, better marketing by vendors, and progressing product

evolution to address items such as higher capacity, faster transfer speeds, and

mobile device integration.

This led us to talk about the recent report from IDC the International Data

Corporation (IDC), which underscores the

personal and entry-level storage market in 2013.

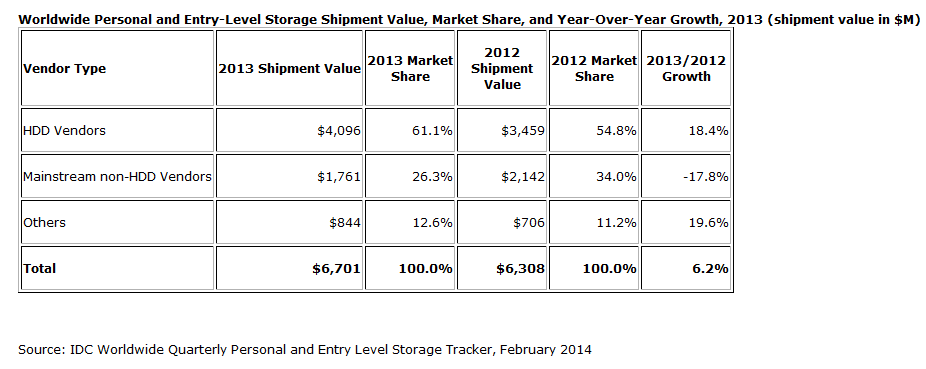

Connectikpeople.co, can observe that, annual shipment values were up year

over year, growing 6.2% to $6.7 billion. 4Q13 shipment values were down year

over year,

declining -10.3% to $1.8 billion.

The Market

Highlights captured by Connectikpeople.co include:

·

Single-bay personal storage

devices remain the most popular choice, representing 98.0% of the personal

storage units shipped in 4Q13.

- The entry-level storage market experienced a growth in unit shipments, gaining 6.8% year over year, based primarily on the 4-bay market, which acts as an easy entry point for vendors to introduce an entry level product. The entry-level market saw unit shipments for the higher bay devices (6, 8, and 12 bays) remain flat with 0.7% year-over-year growth.

- In 4Q13 the personal storage market saw continued decline in growth for dual-bay products, where unit shipments were down -32.2% year over year.

- Personal storage represents 98.8% of the PELS units shipped and 86.9% of the shipment value in 4Q13.

Regarding the Technology Highlights :

- Form Factor: The 3.5" form factor saw a decline of -18.8% year over year in units shipped, while the 2.5" form factor saw units shipped remained flat, growing 0.8% year over year. The 3.5" form factor continues to give way to the more portable 2.5" form factor, with 3.5" losing 3.9 percentage points year over year.

- Capacity Range: End users continue to migrate to higher capacity points to meet storage needs. In the 3.5" personal storage market, 2 terabyte (TB) devices represented 48.3% of unit shipments in the quarter. For the 2.5" personal storage market, 1TB devices captured 58.2% market share. For the entry-level market, capacity ranges are more varied due to multiple bays and vendors' ability to partially populate devices. However, 4TB devices hold the most market share with 28.2% of units shipped.

- Interface: USB continues to be the interface of choice for the PELS market, with 93.3% market share. Ethernet remains the interface of choice for the entry-level market, capturing 95.1% market share. Thunderbolt continues to ramp up, posting a year-over-year shipment growth rate of 282.8%, albeit off a small base.

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and

forecasts for hundreds of technology markets from more than 100 countries

around the globe. Using proprietary tools and research processes, IDC's Trackers

are updated on a semiannual, quarterly, and monthly basis. Tracker results are

delivered to clients in user-friendly excel deliverables and on-line query

tools. The IDC Tracker Charts app allows users to view data charts from the

most recent IDC Tracker products on their iPhone and iPad.

About IDC

International Data Corporation (IDC) is the premier global provider of

market intelligence, advisory services, and events for the information

technology, telecommunications, and consumer technology markets. IDC helps IT

professionals, business executives, and the investment community to make

fact-based decisions on technology purchases and business strategy. More than

1,000 IDC analysts provide global, regional, and local expertise on technology

and industry opportunities and trends in over 110 countries. In 2014, IDC

celebrates its 50th anniversary of providing strategic insights to help clients

achieve their key business objectives. IDC is a subsidiary of IDG, the world's leading technology media, research, and events company. You

can learn more about IDC by visiting www.idc.com.