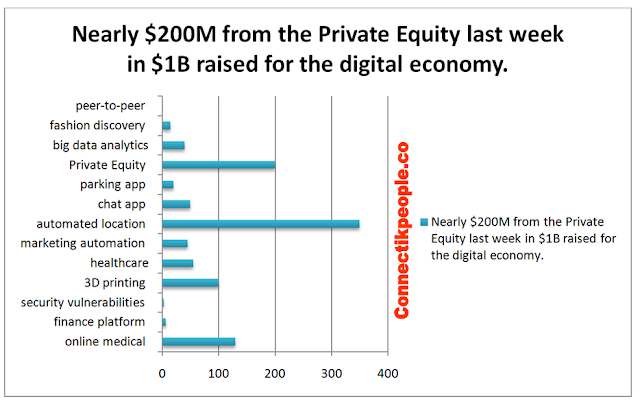

Nearly $200M from the Private Equity last week in $1B raised for the digital economy.

Innovations and services related to: 3D printing, end-to-end big data analytics, carpooling, online medical care, chat app, social news and entertainment have received major consideration from the funding landscape last week.

BuzzFeed social

news and Entertainment Company for example will use the funding to expand its

reach to a younger millennial audience. Kik plans to use the $50M in funding to

become the "WeChat of the West".

Overall,

Connectikpeople.co recalls that:

$1.0M / Series A for

Capital Match is a Singapore-based peer-to-peer

lending platform that aims to create

a more inclusive channel for companies to access debt financing and for

investors to generate strong fixed-income returns.

Investors include: Crystal Horse Investments and Innosight Ventures.

$4.0M / Series A for

YourStory.com ; a media platform that covers the startup

ecosystem in India. The company will launch a platform to allow users to

publish stories and narrate them with text, voice or video.

Investors include :Qualcomm

Ventures, Kalaari

Capital, Ratan

N Tata

and more.

$15M / Series B for

Roposo; a fashion discovery platform that employs

a proprietary recommendation engine to match shoppers.

Investors include: Tiger Global Management.

$40M / Series E for

Datameer, a company

that provides business users with an end-to-end

big data analytics application native for Hadoop. Today's investment brings

the company's total funding raised to over $76M.

Investors include: Kleiner Perkins Caufield & Byers, Redpoint Ventures, Next World Capital and more.

$200M / Private Equity for

BuzzFeed; a social news and entertainment company

providing breaking news, social video, long-form stories, short listicles, and

more. The company will use the funding to expand its reach to a younger

millennial audience.

Investors

include: NBC Universal.

$20M / Series B for

SpotHero ; an on-demand parking app that helps

drivers find off-street parking, compare rates and book a spot in advance.

SpotHero will use the $20M in funding to accelerate marketing efforts, look

into strategic relationships, and hire 25 new employees.

Investors include: 500 Startups, Battery Ventures, Insight Venture Partners and others.

$50M / Series D for

Kik; a chat app based on usernames that allows

users to share content, talk to official accounts, and explore their interests.

Kik plans to use the $50M in funding to become the "WeChat of the

West".

Investors include: Tencent Holdings.

$350M / Series E for

GrabTaxi ; an automated location based smartphone

booking and dispatch platform for the taxi industry in South East Asia.

GrabTaxi plans to use the $350M in funding to continue to diversify its

services, and invest in engineering and hiring.

Investors include: Tiger Global Management, SoftBank, Coatue Management and others.

$45M / Series B for

Kahuna; a marketing automation startup that helps

companies deliver marketing messages to customers in real time. The company will

the new funding for product development and hiring more employees.

Investors include: Sequoia Capital, Felicis Ventures, SoftTech VC and others.

$55M / Series C for

Grand Rounds; a

service companies use to give their employees

access to healthcare advice and treatment around the United States.The

company has raised $106M to date.

Investors include: Greylock Partners, Venrock and David Ebersman.

$100M / Series C for

Carbon3D that builds

3D printers for manufacturers. Henceforth with the new funding, the company

plans to move 3D printing out of the

prototyping phase and into production.

Investors include: Sequoia Capital, Google Ventures, Northgate Capital and others.

$2.3M / Seed for

AppInside that

helps app developers check for security

vulnerabilities by pointing to the code that needs fixing and explaining

how to resolve the issue. Currently based in Tel Aviv, the company plans to

open up a Boston office with the seed funding.

Investors include: Accomplice.

$7.0M / Series B for

Guiabolso ; a

Brazil-based personal finance management

platform that automates budgeting and guides financial decision-making.

Investors include: Omidyar Network, QED Investors, Kaszek Ventures+ 5 more

investors.

$130M / Series D for

ZocDoc ; a New

York-based online medical care

schedule service. In addition to the $130M Series D, it has raised a total of

around $230M.

Investors include: Founders Fund, Atomico and Baillie Gifford.