SAP and CFO Research: Treasuries Demand Optimization and Upgrading of Information Systems.

The study is now public; it has been revealed during the International SAP Conference for Financial Services(July 8-10 in London).

According to SAP and CFO Research, nearly two-thirds of corporate finance executives expect to see some degree of change

in treasury over the next two years, with 16 percent planning extensive changes. Top priorities include optimizing treasury processes (44 percent) and upgrading treasury information systems and technology (38 percent).

In the same study, Connectikpeople has discovered that, Twenty-two percent of corporate treasurers said their current information systems support treasury very well, and many are taking steps to streamline disparate, expensive connections with various banks by seeking banking partners that can efficiently support their growing role.

According to SAP and CFO Research, nearly two-thirds of corporate finance executives expect to see some degree of change

in treasury over the next two years, with 16 percent planning extensive changes. Top priorities include optimizing treasury processes (44 percent) and upgrading treasury information systems and technology (38 percent).

In the same study, Connectikpeople has discovered that, Twenty-two percent of corporate treasurers said their current information systems support treasury very well, and many are taking steps to streamline disparate, expensive connections with various banks by seeking banking partners that can efficiently support their growing role.

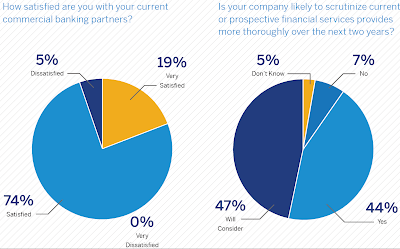

Twenty-nine percent of respondents indicated they will seek new banking

partners over the next two years, while half will consider a search. Treasurers

are seeking a consultative relationship with their bank that provides

visibility into cash flow, funding and risk considerations to guide their

business decision-making. As such, 91 percent of respondents are considering

increased scrutiny of current and prospective providers over the next two

years, and 65 percent felt their company had some or significant room to

improve its communication integration with banks.

To resolve issues surrounding collaboration and connectivity and to meet the rising needs of their companies, treasurers have begun looking to cloud-based solutions. Fifty-seven percent of respondents said they would be early adopters or fast followers of cloud services for banking relationships, yet looming regulatory and security concerns have made banks reticent to dive into cloud computing.

About SAP® Financial Services Network: To resolve issues surrounding collaboration and connectivity and to meet the rising needs of their companies, treasurers have begun looking to cloud-based solutions. Fifty-seven percent of respondents said they would be early adopters or fast followers of cloud services for banking relationships, yet looming regulatory and security concerns have made banks reticent to dive into cloud computing.

SAP® Financial Services Network enables banks to efficiently integrate processes with their corporate customers, leading to increased connectivity across financial supply chains. As banks improve their processes and focus on developing new solutions, it allows treasurers to focus on stepping into their new roles as strategic advisors.