Dear professionals, Middle East and Africa (MEA) x86 Server Market Enjoy Strong Growth in Q3 2013, Says IDC.

Progressively Middle East and Africa (MEA) zone demonstrates its potential. Thanks

to the latest insights from International Data Corporation (IDC).

Connectikpeople.co has received the latest 'EMEA Quarterly Server Tracker'.

According to International Data Corporation (IDC) the research and advisory firm,

the MEA x86 server market expanded 9.9% in volume during Q3 2013, with revenue

rising 10.6% over the same

period.

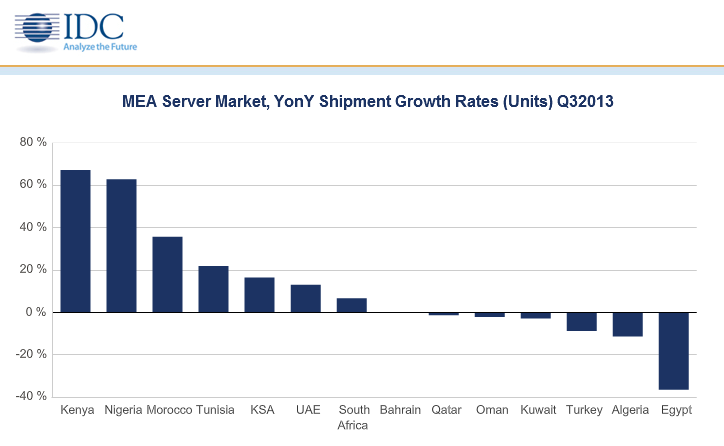

Connectikpeople.co can observe: The Saudi market was the standout performer

of the quarter in the GCC, registering strong year-on-year volume growth of

16.4%. "Several major deals were completed with various government

ministries, banks, and education institutes during the quarter, combining to

drive the strong growth seen in Q3," says Zeeshan Gaya, research manager

for servers and systems at IDC Middle East, Africa, and Turkey. "The UAE

market also exhibited strong year-on-year growth, with shipments increasing

13.0% on the back of key projects taking place in the government and banking

sectors."

In contrast the so-called 'Other GCC' (OGCC) bloc of countries, comprising

Bahrain, Kuwait, Oman, and Qatar, suffered a marginal 1.8% decline in volume

over the same period, although there was a significant year-on-year increase of

22.6% in revenue. The growth in revenue came as a direct consequence of the

average selling price of a server increasing 24.8% compared to Q3 2012.

As expected, the Egyptian market slumped 36.6% year on year in volume terms

as a result of severe project delays and cancellations brought about by the

ongoing political instability in the country and associated uncertainty.

Indeed, the only noticeable projects seen in Egypt during Q3 2013 were for the

Egyptian Stock Exchange and within the defense sector.

Turkey also experienced a downward trend in the third quarter of the year,

with unit shipments dipping 8.8% year on year. The government, banking, and

telecommunications sectors were the key IT spenders in the country during this

period. "The Turkish government is proactively taking necessary measures

to increase the economic and political resilience of the country," says

Adriana Rangel, research director for systems and infrastructure solutions at

IDC Middle East, Africa, and Turkey. "It is also striving to improve the

investment environment in an attempt to facilitate and stimulate continuous

economic growth. Additionally, local elections scheduled for mid-2014 are

expected to have a positive impact on IT spending in the country."

Strong year-on-year shipment growth of 35.7% and 21.8% was recorded in

Morocco and Tunisia, respectively, stimulated by the stable nature of the

political situation in these countries and corresponding investments in the

government, banking, and telecommunications sectors. Overall, the North Africa

region performed well in Q3 2013, registering a 20.4% increase in volume when

compared to the corresponding quarter in 2012.

The Kenyan and Nigerian markets secured the highest growth seen across the

entire MEA region in Q3 2013, registering an annual shipment growth of 67.1%

and 62.8%, respectively. "Sizeable projects conducted by financial

institutions and telecom operators contributed to the strong server growth seen

in Nigeria, while the majority of large deals conducted in Kenya during the

third quarter of the year were in the banking and utilities sectors, with the

government sector taking a back seat," says Gaya.

South Africa experienced a 6.6% year-on-year increase in server shipments,

driven primarily by investments in the government and financial services

sectors. "Server uptake in the small and medium-sized business (SMB) space

was sluggish in South Africa during Q3 2013, with the majority of spending

coming from the enterprise segment," continues Gaya. "The purchasing

pattern among mid-to-large organizations has been gradually shifting from

standalone servers to converged and integrated solutions. However, some large

government deals are in the pipeline for Q4, with a particular emphasis on egovernment

initiatives such as smart energy management solutions and smart city

programs."

Growth was seen across all the major form factors in the MEA region during

Q3 2013. Blades were the market's strongest performers, with shipments up 27.5%

year on year, followed by rack-optimized and tower servers, with increases of

8.7% and 3.2%, respectively. Bucking the trend somewhat, shipments of

density-optimized servers were down 22.9% year on year across the MEA region.

Shipments of one-socket servers grew an impressive 24.8% over Q3 2012,

securing market share of 30.4%, up 3.6 percentage points higher than last year.

Two-socket servers remain the dominant socket capability, however, comprising

more than half of the MEA market with 65.1% unit share. Four- and eight- socket

servers continued to grow in the third quarter of the year, recording

year-on-year volume increases of 24.3% and 47.4%, respectively.

About the Research

IDC's 'EMEA Quarterly Server Tracker' is a quantitative tool for

analyzing the server market on a quarterly basis. The tracker includes

quarterly shipments (both ISS and upgrades) and revenues (both customer and

factory), segmented by vendor, family, model, region, country, operating

system, price band, CPU type, and architecture.

About IDC

International Data Corporation (IDC) is the premier global provider of

market intelligence, advisory services, and events for the information

technology, telecommunications, and consumer technology markets. IDC helps IT

professionals, business executives, and the investment community make

fact-based decisions on technology purchases and business strategy. More than

1,000 IDC analysts provide global, regional, and local expertise on technology

and industry opportunities and trends in over 110 countries worldwide. For more

than 49 years, IDC has provided strategic insights to help our clients achieve

their key business objectives. IDC is a subsidiary of IDG, the world's leading

technology media, research, and events company. You can learn more about IDC by

visiting www.idc.com.

IDC in the Middle East, Africa, and Turkey

For the Middle East, Africa, and Turkey region, IDC retains a coordinated

network of offices in Riyadh, Casablanca, Nairobi, Lagos, Johannesburg, and

Istanbul, with a regional center in Dubai. Our coverage couples local

insight with an international perspective to provide a comprehensive

understanding of markets in these dynamic regions. Our market intelligence

services are unparalleled in depth, consistency, scope, and accuracy. IDC

Middle East, Africa, and Turkey currently fields over 125 analysts,

consultants, and conference associates across the region.