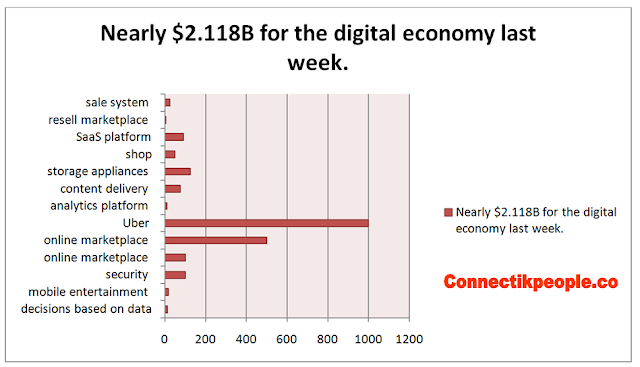

Nearly $2.118B for the digital economy last week.

Carpooling, with Uber leading the game, the Private

Equity, the online market, security and storage appliances have shook up the

wallet last week.

Connectikpeople.co has captured nearly $2.118B in funding for the digital economy last week.

Investors and companies include:

$12M / Series A for

Panorama that surveys students, parents and teachers to help schools make decisions based on data.

Launched in 2013, Panorama has raised $16M to date.

Investors

include: Y Combinator, Google Ventures, Spark Capital and others.

$18M / Series A for

Seriously, a mobile entertainment startup behind the

game 'Best Fiends'. With $28M in total funding, Seriously intends to expand

production efforts and invest in marketing initiatives.

Investors include: Upfront Ventures, Northzone, Sunstone Capital and others.

$100M / Series B for

Zscaler that offers

integrated, cloud-delivered Internet security

including web security, firewalls, mobile security, IoT security and DLP. The

company will use the funding to accelerate investment in its technology and

grow its customer base.

Investors include: Lightspeed Venture Partners, TPG Growth and EMC.

$100M / Series B for

OYO Rooms, an

India-based online marketplace for

affordable hotels. OYO Rooms aims to scale to 50,000 in 200 locations by the

end of this year.

Investors

include: Sequoia Capital, Lightspeed Venture Partners, SoftBank and others.

$500M / Private Equity

Snapdeal is an

Indian online marketplace for

branded products such as mobiles, electronics, apparel and accessories. Founded

in 2010, Snapdeal has raised $1.6B to date.

Investors include: Alibaba, SoftBank and Foxconn Technology Group.

$1.0B / Series F for

Uber with a valuation reported to be just over $50B. This

brings Uber's funding total to $6.9B across 11 rounds from 44 investors.

Investors

include: Microsoft and Bennett Coleman and Co Ltd and more.

$9.0M / Series A for

Amplitude, a scalable analytics platform built to

fuel app growth. With the $9M, Amplitude plans to offer its basic features for

free.

Investors include: Benchmark, Data Collective, Quest Venture Partners and more.

$75M / Series D for

Fastly, a content delivery service that helps

companies quickly deliver dynamic content to their users. Fastly will use the

$75M to develop new delivery solutions, expand globally, and invest in security

and e-commerce.

Investors include: Battery Ventures, August Capital, O'Reilly AlphaTech Ventures and others.

$125M / Series F for

Tintri that develops

VM-aware storage appliances that

increase the performance of virtual servers and desktop environments. Tintri

says it will use the $125M to expand globally via marketing and to increase its

user base.

Investors include: New Enterprise Associates, Lightspeed Venture Partners, Menlo Ventures and others.

$50M / Venture for

Enjoy that provides

consumers who shop on its website or

partner sites with free delivery of their tech devices from experts. The latest

round brings Enjoy's total funding to $80M.

Investors include: Kleiner Perkins Caufield & Byers, Highland Capital Partners and

Oak Investment Partners.

$90M / Series C for

Practo.com that

allows patients to find and book appointments with doctors through its SaaS platform. With the new capital,

the company plans to expand its presence both in India and overseas.

Investors

include: Sequoia Capital, Matrix Partners, Tencent Holdings and others.

$4.0M / Seed for

Rebagg, an online resell marketplace for designer

handbags. Rebagg will use the $4M seed funding to further expand its

third-party resell network across the U.S. and grow its team.

Investors include : General Catalyst Partners, Founder Collective, Crosslink Capital and others.

$11M / Series A for

Jibo , a household robot that provides a variety

of services, including sending email, ordering food, and connecting with

internet-of-things devices.

Investors include: KDDI, Acer, LG Uplus and more.

$24M / Series C for

Ezetap , a point of

sale system that allows a mobile

device to read any card and complete any financial transaction. Founded in

2011, the company has raised $35M in total.

Investors include: The Social+Capital Partnership, Horizons Ventures and Helion Venture Partners.