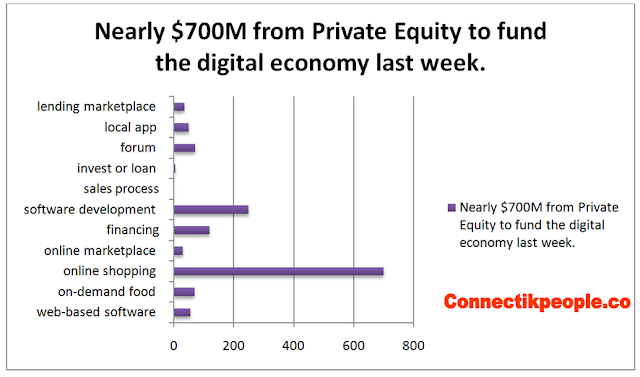

Nearly $700M from Private Equity to fund the digital economy last week.

As a whole, the digital economy

has absorbed nearly $1.399B last week with a great

focus

on online shopping; financing options; software development

collaboration service and others.

Below let’s discover the overall trend.

$55M / Series H for

Kareo that delivers web-based

software helping small practice physicians run their business and collect

payments from insurance companies and patients. The company will use the

funding to expand its U.S. footprint and build out additional products and

services.

Investors include: OpenView Venture Partners, Greenspring Associates, Montreux Equity Partners and others.

$70M / Series C for

Deliveroo, an on-demand food ordering startup that

offers delivery from premium restaurants that don't traditionally offer a

take-out service. The company has raised approximately $100M to date.

Investors include: Accel Partners, Index Ventures, Hoxton Ventures and more.

$700M / Private Equity

Flipkart is an

India-based online shopping

destination for electronics, books, music and movies. By next September, the

company plans to transition to an app-only service model.

Investors include: Tiger Global Management, DST Global, Iconiq Capital and others.

$30M / Series A for

Thrive Market, an online marketplace for high-quality,

organic, and natural products. Thrive will use part of the funding to open up a

new fulfillment center in Indiana.

Investors include: Greycroft Partners, Scripps Networks Interactive, Powerplant Ventures and more.

$119M / Series B for

Behalf that aims to

make financing options simple for

small and mid-sized businesses by enabling businesses to buy more and vendors

to sell more.

Investors include: Sequoia Capital, Spark Capital, Victory Park Capital and more.

$250M / Series B

GitHub is a software development collaboration service

based in San Francisco. Led by Sequoia, the $250M Series B round will be used

to accelerate growth and expand the company's sales and engineering team.

Investors include: Sequoia Capital, Andreessen Horowitz, Institutional Venture Partners (IVP) and others.

$1.7M / Seed for

PersistIQ that automates the outbound sales process.

Investors include: Y Combinator, Salesforce Ventures and Point Nine Capital.

6.0M GBP / Series C for

Crowdcube that enables

individuals to invest or loan in small

companies in return for equity or an annual return. The latest round of

funding puts the company at a valuation of $80M.

Investors include: Balderton Capital, Draper Esprit, Numis and more.

$10M / Series A for

Olio Devices that develops

luxury lifestyle products and wearables

for modern professionals. The company will use the cash to expand Olio's

manufacturing activities and bring on new hires.

Investors include: New Enterprise Associates.

$72M / Series E for

Avvo , a legal

marketplace, directory, and question and

answer forum that connects individuals with lawyers.

Investors include: Technology Crossover Ventures, Vulcan Capital and

Coatue Management.

$50M / Venture for

Little, an India-based hyper-local app that helps

you find the best deals on restaurants, movies, hotels, salons, gyms, spas and

other things around you.

Investors include: Tiger Global Management, SAIF Partners and Paytm.

$35M / Series C for

China Rapid Finance;

China’s largest online consumer lending

marketplace serving online users and China's emerging middle class.

Investors include :Broadline

Capital.