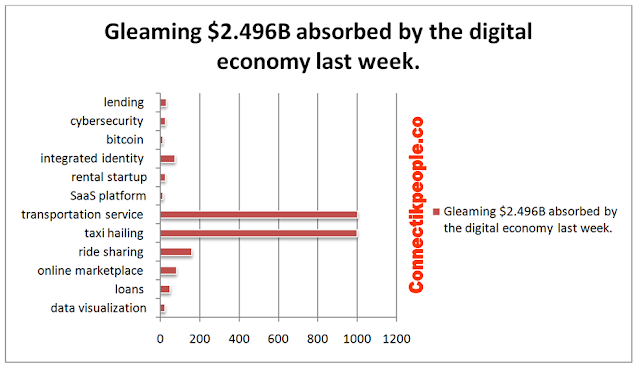

Gleaming $2.496B absorbed by the digital economy last week.

$2.2B in Private Equity to boost taxi hailing companies including Uber and Didi-Kuaidi.

Overall, Connectikpeople.co can recall:

$23M / Series B for

CartoDB that lets users upload their data and visualize it with a variety

of mapping templates. With the new funding, CartoDB will bring its data visualization tools to individual

and business users worldwide.

Investors

include: Accel Partners, Earlybird Venture Capital, Kibo Ventures and more.

$50M / Series C for

Fundbox that issues

loans to small businesses that run

on invoices by plugging into a company's existing accounting software and

assessing invoices individually.

Investors include: Shlomo Kramer, Bezos Expeditions, Blumberg Capital and more.

$81M / Series E for

thredUP ; an online marketplace to buy and sell used

women's and kids' clothing. The company has raised over $125M in funding to

date, and will use the new funding to expand operations.

Investor

in clued: Goldman Sachs.

$160M / Series D for

BlaBlaCar ; a long-distance ride sharing platform

based in France. Since the company's last funding round in 2014, it has

expanded into 5 additional countries.

Investor include: Insight Venture Partners.

$1.0B / Private Equity for

Didi-Kuaidi ; a

combination of the two largest taxi

hailing companies in China, Didi Dache and Kuaidi Dache. This round of

funding is an extension to the $2B round that the company announced in July

2015, bringing this round to $3B total.

$1.2B / Private Equity for

Uber ; an on-demand transportation service that connects

passengers with drivers through a mobile application. The company is working

with Baidu to develop its presence in China by focusing on staffing and

integration with local maps and other services.

Investor include: Baidu.

$14M / Series B for

Freightos that allows

logistics companies to manage contracts

and automate the quotation and sales process through its SaaS platform. The company has raised

over $23M to date.

Investors include: Aleph, Israel Cleantech Ventures (ICV), Sadara Ventures and others.

$25M / Series B for

The Black Tux ; a tuxedo suit and rental startup. With

the new funding, the company has raised $40M since 2012.

Investors

include: Stripes Group, First Round and Menlo Ventures.

$75M / Series F for

Okta ; an integrated identity and mobility management

service that connects people to their applications from any device at any time.

The company raised an identical $75M Series E round last June, and will use the

new capital for strategic acquisitions.

Investors

include: Andreessen Horowitz, Greylock Partners, Sequoia Capital and more.

$12M / Series A for

Abra ; a global

cash-transfer network that utilizes bitcoin

to power remittances. The startup has raised $14M since March 2015.

Investors include: Arbor Ventures, RRE Ventures, First Round and more.

$26M / Series B for

Argus that provides

cybersecurity solutions for the automotive industry to manage security issues in connected automobiles.

Founded in 2013 and based in Tel Aviv, the company has raised $30M to date.

Investors

include: Magna International, Allianz, SBI Holdings and more.

$30M / Series B for

Orchard; a

technology and infrastructure provider for

marketplace lending based in New York. With $45M raised to date, the

company aims to simplify lending for institutional investors as well as

originators.

Investors

include: Spark Capital, Thrive Capital, Jon Winkelried and others.