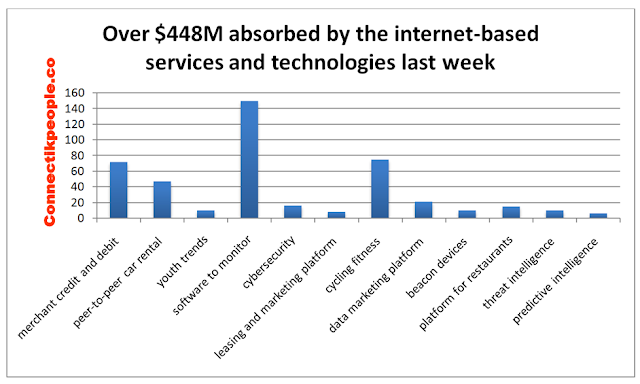

Over $448M absorbed by the internet-based services and technologies last week

With $158M / Series F ,AppDynamics, a San Francisco-based company that makes software to monitor the performance of business applications, has received a particular treatment and is henceforth valued at $1.9B.

Overall, Connectikpeople.co can recall:

$72M / Venture for

Tyro Payments; an Australian financial institution

specializing in merchant credit and

debit acquisition. Nearly $104M raised to date.

Investors

include : Mike Cannon-Brookes ;

Tiger Global Management ;

TDM Asset Management

$47M / Series B for

Atzuche ; a Shanghai-based peer-to-peer car rental start-up. Founded in 2013, Auzuche

currently operates in 12 Chinese cities with over one million users.

Investors

include: Matrix Partners,

Ivy Capital,

China Pacific Insurance,

Ceyuan Ventures

and more.

10M EUR / Series C for

Melty; a French news site focused on youth trends. Almost £15M raised to

date.

Investors

include: Jaina Capital

(Lead), Serena Capital,

Bouygues Telecom

$158M / Series F for

AppDynamics ; a San Francisco-based company that makes

software to monitor the performance

of business applications.

Investors

include: General Catalyst Partners

(Lead), Altimeter Capital

(Lead), Greylock Partners,

Adage Capital Management

and more.

$16M / Series B for

ThreatConnect, that provides cybersecurity and threat intelligence products and services for

enterprise users. Founded in 2011 , the company has raised $22M to date.

Investors

include: Grotech Ventures,

SAP and more.

$8.0M / Series A for

Nestio; a New York-based leasing and marketing platform for residential landlords. Trinity

Ventures, the lead investor in Nestio's Series A, counts LoopNet, DotLoop,

MyNewPlace and VTS among its real estate tech investments.

Investors

include: Trinity Ventures

(Lead), Freestyle Capital,

Joanne Wilson,

David Cohen.

$75M / Private Equity for

Peloton ; an indoor cycling fitness company that livestreams exercise content live and

on-demand.

Investors

include: Catterton.

$21M / Series B for

Bluecore ; a data

marketing platform for ecommerce brands, letting them send more powerful

emails to drive higher conversion. Blucore has raised $28.2M to date.

Investors

include: Georgian Partners

(Lead), FirstMark Capital,

Felicis Ventures.

$10M / Series A for

Sensoro , that manufactures beacon devices that can collect and send information based on

proximity.

Investors

include: New World Development,

Nokia Growth Partners,

Mandra Capital.

$15M / Series C for

EatStreet ; a platform

for restaurants, mainly located in smaller cities, to take orders online or

by mobile. Founded in 2010 and based in Madison, WI, EatStreet currently works

with 15,000 restaurants across 250 cities.

Investors

include: Lumia Capital

(Lead), 4490 Ventures

(Lead).

$10M

/ Series A

for

ThreatQ , that operationalizes threat intelligence for enterprise companies. Launched in 2013,

ThreatQ has raised $12.2M to date.

Investors

include: New Enterprise Associates.

$6.0M / Series A for

BrightFunnel that generates predictive intelligence and actionable revenue insights for B2B

marketers.

Investors

include: Crosslink Capital

(Lead), Karlin Ventures,

Salesforce Ventures,

Bloomberg Beta

and more.