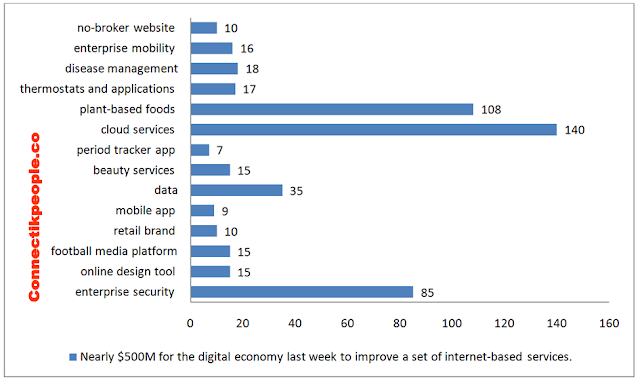

Nearly $500M for the digital economy last week to improve a set of internet-based services.

Services and

technologies related to: enterprise security tool; online design tool; football media platform; single

hub for customer data;

enterprise mobility platform and cloud have grabbed the essential of the kitty.

Overall Connectikpeople.co can recall:

$85M / Series B for

Code42 t

Investors include : JMI Equity (Lead) ; New Enterprise Associates (Lead); Split Rock Partners; Accel.

$15M / Series A for

Canva ; an online design tool that empowers anyone

to create professional graphics. This round marks the largest check that

Felicis Ventures has written for a company.

Investors include : Felicis Ventures (Lead) ; Vayner/RSE; Matrix Partners; Blackbird Ventures.

$15M / Venture for

90min; a contributor-driven football media platform. Alongside

ProSiebenSat.1, the lead investor of this round, the company is launching a

co-branded joint venture targeting the German football market.

Investors include: ProSiebenSat.1 Media SE (Lead); Battery Ventures; Gemini Israel Ventures; Dawn Capital.

$10M / Series B for

Draper James; a

Southern-inspired retail brand

founded by actress Reese Witherspoon.

Investors include: Forerunner Ventures (Lead) ; JH Partners; Stone Canyon Industries.

$8.5M / Series A for

Neumob; a service that helps mobile app developers get their in-app

content to users faster. It plans to use the $8.5M Series A to accelerate its

go-to-market and customer acquisition strategies.

Investors include : Accel (Lead) ; Eniac Ventures; Lightbank; Ben Narasin and more.

$8.0M / Series A for

Runtitle ; the largest database of net mineral ownership data.

Based in Austin, Texas, the company plans to use its funding to expand its

dataset and its team.

Investors include: Founders Fund; Austin Ventures; Deep Fork Capital.

$27M / Series B for

Segment; a San Francisco-based

company that aims to make accessing information easier across companies by

providing a single hub for customer data.

Investors include: Accel; Thrive Capital; Jon Winkelried; Jon Winkelried ; Kleiner Perkins Caufield & Byers.

$15M / Series B for

Glamsquad ; an on-demand mobile beauty services

company that allows customers to book hair and makeup appointments and have a

stylist sent to their location. Henceforth they plan to expand its services to

more cities.

Investors include: Lerer Hippeau Ventures; BBG Ventures; SoftBank Capital; Montage Ventures.

$7.0M / Series A for

Clue; a Berlin-based period tracker app designed to let

women keep tabs on their monthly cycles and help predict their fertile window,

as well as other hormonal changes.

Investors include: Union Square Ventures; Mosaic Ventures.

$140M / Series E for

AppDirect; a cloud services provider that allows its

customers to sell their own software through online marketplaces.

Investors include : JP Morgan Chase & Co. (Lead); Stingray Digital; Foundry Group; Mithril Capital Management.

$108M / Series D for

Impossible Foods

that creates plant-based foods to

serve as meat and dairy equivalents.

Investors include : UBS (Lead) ; Horizons Ventures; Bill Gates; Viking Global Investors.

$17M / Series B for

tado that offers

smart thermostats and applications

for homes and businesses that adjust to residents' behavior in real time.

Investors include : Statkraft Ventures; BayBG; Siemens Venture Capital; Target Partners.

$18M / Series B for

CareSync that provides

software and services for chronic

disease management, including 24/7 nursing services for patients. The

company has raised $23M to date.

Investors include : Merck Global Health Innovation Fund (Lead); Tullis Health Investors; Harbert Venture Partners; Clearwell Group.

$16M / Series B for

MOVE Guides; an enterprise mobility platform that

connects vendors with employers. The new capital will be used to launch new

products to improve the employee relocation experience.

Investors include : Notion Capital (Lead) ; New Enterprise Associates (Lead).

$10M / Series B for

Grabhouse; a no-broker website that helps people

find apartments, roommates and tenants in India. The new capital comes from two

previous investors and brings the company's total funding to $13M.